TL;DR Summary of Top 7 Preqin Alternatives for Private Market Investing

Optimixed’s Overview: Discovering the Best Platforms Beyond Preqin for Alternative Asset Investing

Understanding Preqin’s Role and Its Alternatives

Preqin is widely recognized for empowering investors with comprehensive data and connections in private market assets such as real estate, infrastructure, and startups. However, it primarily serves as a research and networking tool rather than a direct investment platform. Depending on your goals—whether you want to conduct deep research, invest directly, or spot emerging trends—several competitors offer unique advantages.

Key Alternatives and Their Distinctive Features

- Yieldstreet: Ideal for individual investors seeking to manage their own portfolios with access to alternative assets like art and private credit. Offers direct investment and FDIC-insured accounts with a reported net annualized return of 9.7%.

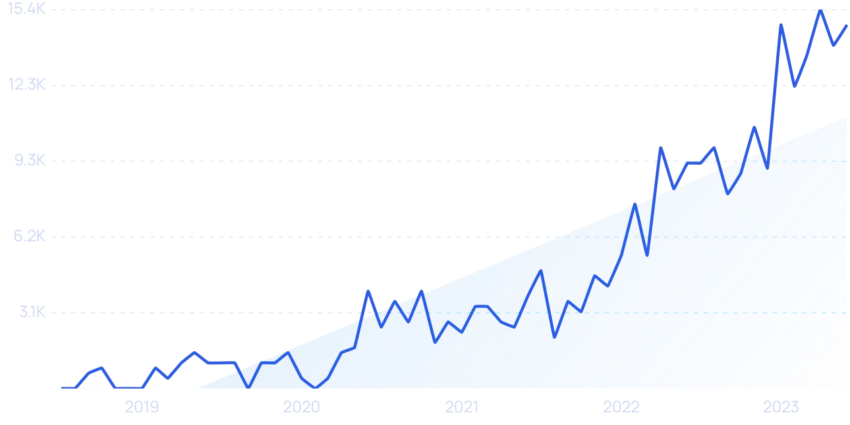

- Exploding Topics: Focuses on early detection of high-growth startups and trending industries through AI-driven data, perfect for venture capitalists and investors targeting emerging businesses.

- Harmonic: An AI-powered platform emphasizing founder tracking and startup momentum, useful for venture capital, private equity, and angel investors.

- Forge Global: Combines private company data analytics with a marketplace for trading private securities, suited for investors looking to actively trade pre-IPO assets.

- Moonfare: Connects accredited investors with private equity fund managers and enables direct fund investments and trading within a qualified investor community.

- McKinsey Global Private Markets Review: Provides free, authoritative annual reports on private market trends and performance, excellent for broad market insights.

- S&P Capital IQ Pro: Offers blended public and private market data, including Preqin’s insights, catering to investors with diversified portfolios across markets.

Choosing the Right Platform for Your Investment Journey

Your choice depends on your experience level and investment preferences:

- New or individual investors may benefit from platforms like Yieldstreet that support direct investing with guidance and manageable minimums.

- Experienced investors and institutions might prefer Exploding Topics or Harmonic for advanced startup research or Forge Global and Moonfare for direct market participation.

- For market intelligence and trend analysis, McKinsey’s reports and S&P Capital IQ Pro provide reliable data sets and expert insights.

By evaluating each platform’s strengths—whether in research, investing, or community access—you can tailor your approach to alternative asset investing and maximize your portfolio’s potential.