TL;DR Summary of U.S. Trends in AI Tool and Traditional Search Engine Usage

Optimixed’s Overview: Analyzing the Coexistence and Growth Patterns of AI Tools and Search Engines in America

Robust Traditional Search Usage Amid Rising but Slowing AI Adoption

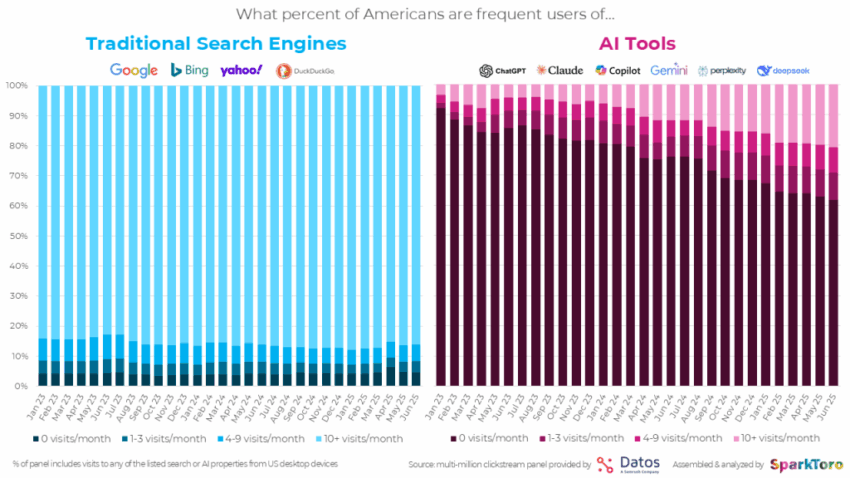

Recent analysis of millions of U.S. desktop devices reveals a nuanced digital landscape where traditional search engines such as Google, Bing, Yahoo, and DuckDuckGo maintain overwhelming dominance. Approximately 95% of Americans use traditional search engines monthly, with heavy users (10+ visits/month) growing slightly from 84% in early 2023 to 87% in 2025. This demonstrates the enduring relevance and maturity of traditional search despite the surge in AI tool popularity.

Rapid Growth and Emerging Plateau in AI Tool Usage

- AI tools, including ChatGPT, Claude, Copilot, and others, have seen usage quintuple from 8% to 38% over two and a half years.

- Heavy AI tool users (10+ visits/month) increased from 3% in early 2023 to 21% in mid-2025.

- Growth rate of AI adoption is decelerating, with no month surpassing 1.1x growth since September 2024, signaling a potential plateau within the next 12–24 months.

Complementary Relationship Between AI and Traditional Search

Contrary to the popular “AI vs. Search” narrative, data indicates AI adoption expands overall search activity rather than replaces it. New AI users tend to increase their traditional search queries, reinforcing the coexistence of both technologies. This suggests AI tools serve as a complement to, rather than a substitute for, established search engines.

Insights for Marketers and Industry Leaders

Understanding these trends is crucial for strategic decision-making. Adoption rates vary significantly by audience segment, so businesses should analyze AI usage within their specific customer base rather than relying solely on broad U.S. averages. Additionally, seasonal fluctuations—such as summer usage dips likely linked to education—should inform timing and targeting strategies.

Data and Methodology Notes

- Data is derived from desktop device clickstream panels and excludes mobile app usage, ensuring accurate measurement of web-based tool engagement.

- The U.S. trends closely mirror EU/UK patterns, with slightly higher AI adoption (~10%) in those regions.

- Clickstream data provides an objective alternative to self-reported surveys, capturing real user behavior rather than perception.