TL;DR Summary of Top 10 PitchBook Alternatives for Startup and Investment Research

Optimixed’s Overview: Exploring the Best Investment Research Platforms Beyond PitchBook

Introduction to PitchBook Alternatives

PitchBook is widely recognized for its extensive market intelligence covering financials, funding sources, M&A activity, and executive profiles. However, investors and professionals seeking more tailored features or different pricing options have a variety of alternatives to consider. These platforms range from AI-powered startup discovery tools to comprehensive databases focused on investor relations, financial metrics, and market trends.

Key Alternatives and Their Unique Strengths

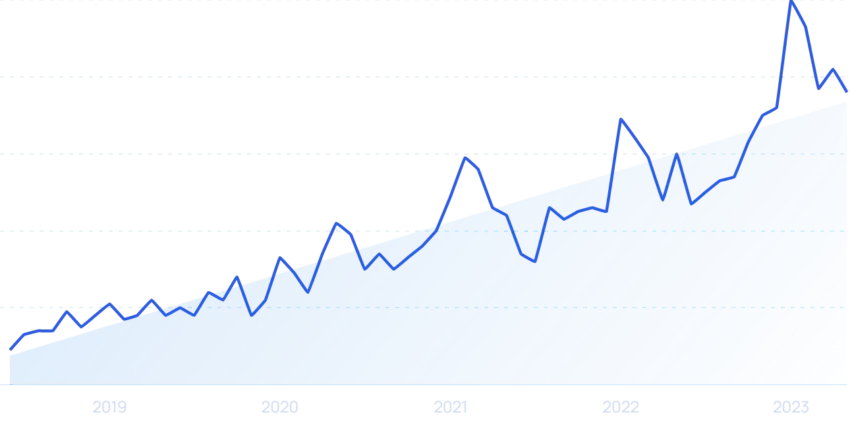

- Exploding Topics: Ideal for investors targeting early-stage startups, leveraging AI to identify emerging companies before they gain widespread attention. Features include daily updated startup databases, meta trend analysis, and detailed company profiles starting at $99/month.

- Growjo: A free, straightforward database offering basic startup data such as estimated revenue and funding. Best suited for casual users looking for quick overviews.

- Dealroom: Covers over two million startups and includes bespoke research services, making it valuable for investors needing tailored insights and entrepreneurs seeking investor connections.

- Tracxn: Focuses on VC, PE, and M&A teams with extensive company data and infographic creation tools. Its pricing starts at $1,100/month for three users.

- Crunchbase: Combines company funding details with outreach capabilities, supporting sales and investment prospecting at an accessible entry price of $29/month.

- S&P Capital IQ Pro: A powerhouse platform for corporate M&A teams, offering advanced financial data, risk analytics, and merger visualization tools. Pricing is customized per client.

- Republic: Enables new investors to participate in startup funding through an online marketplace, including access to SEC filings and company overviews, with no upfront browsing cost.

- Harmonic AI: Utilizes AI for real-time tracking of startups, founder networks, and funding events. Features include relationship mapping and data export, suited for early-stage discovery with custom pricing.

- CB Insights: Employs AI to predict industry trends and assess investment opportunities, suitable for VC firms interested in detailed market and company intelligence.

- AlphaSense: An AI-enhanced search engine designed to streamline market research by aggregating financial news, earnings calls, and regulatory filings for investment firms.

Choosing the Right Tool for Your Investment Needs

Each platform offers a unique combination of data depth, AI integration, and user experience. For early startup detection, Exploding Topics and Harmonic AI are top contenders, while CB Insights and Dealroom provide high-level market and investor insights. For corporate M&A professionals, S&P Capital IQ Pro and PitchBook remain excellent choices. Additionally, Crunchbase and Republic offer features that support both investment and sales prospecting. Ultimately, selecting the right platform depends on your specific investment strategy, budget, and the type of data required.