TL;DR Summary of Meta’s Q3 Performance Update Highlights AI and VR Investment

Optimixed’s Overview: Meta’s Strategic Expansion in AI and VR Amid Strong User Growth and Revenue Gains

Robust User Base and Revenue Growth

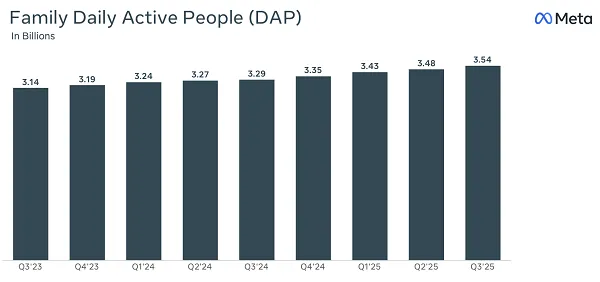

Meta continues to expand its global reach, adding 60 million users in Q3 to a total of 3.54 billion across Facebook, Instagram, Messenger, WhatsApp, and Threads. This growth is notable given saturation in key markets, driven largely by developing regions and new platform adoption. Financially, Meta posted $51.24 billion in revenue, a 26% year-over-year rise, predominantly from its advertising business which accounts for 97% of income.

Investment in AI and Augmented Reality Technologies

- AI Infrastructure: CEO Mark Zuckerberg anticipates spending around $65 billion on AI infrastructure in 2024, with expectations for even greater capital expenditure in 2026 to support expanding compute needs.

- AR Glasses Development: Meta launched its ‘Display’ AR glasses model and plans to ship fully AR-enabled glasses to developers next year, aiming for a 2027 retail release that could transform device connectivity.

- Data Centers: The new $1.5 billion data facility in El Paso, Texas, marks Meta’s 29th US data infrastructure project, bolstering its AI supercomputing capabilities.

Challenges and Market Risks

Despite promising advancements, Meta’s Reality Labs division posted a $4.4 billion loss in Q3, reflecting high R&D expenses. Regulatory scrutiny in the US and EU, particularly around youth-related social media policies and ad personalization, may impact future revenue streams. Moreover, the AI race’s escalating costs could marginalize smaller competitors, positioning Meta as a potential leader but also increasing pressure to deliver transformative AI solutions.

Long-Term Outlook

Meta’s aggressive investments in AI and VR demonstrate a strategic bet on emerging technologies as drivers for future growth. While current AI tools have yet to fully meet transformative expectations, Meta’s scale and resource commitment aim to establish dominance in these sectors. The company’s ability to navigate regulatory risks and convert innovation into profitable products will be crucial for sustaining its market leadership.