TL;DR Summary of Top Banking Trends Transforming Finance in 2024

Optimixed’s Overview: Key Innovations and Market Shifts Driving the Future of Banking

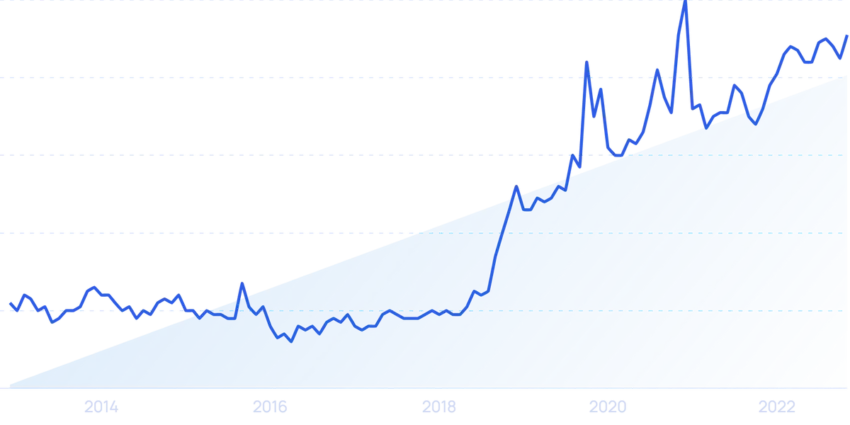

1. Artificial Intelligence Revolutionizes Banking Operations

AI adoption is transforming productivity and compliance in banking, with a potential $340 billion annual value increase. Many banks implement generative AI for risk management, fraud prevention, and customer engagement. For example, Provenir’s AI-driven credit risk platform and Boost.AI’s chatbots demonstrate how AI enhances decision-making and customer support.

2. Neobanks Expand Rapidly, Challenging Traditional Banks

- Neobanks like Chime, Revolut, and Monzo serve over 1 billion customers globally, handling trillions in transactions.

- Chime leads in the US with 38 million accounts and consumer-friendly features such as no overdraft fees and early wage access.

- Fintechs are increasingly obtaining banking licenses, signaling a shift toward digital-first banking.

3. Open Banking Promotes Transparency and Consumer Control

Open banking leverages APIs to enable third-party apps that improve financial data accessibility and payment processing. The UK and EU lead in adoption, with significant growth in open banking payments and third-party providers (TPPs). In the US, platforms like Plaid connect millions of users, fostering innovation in financial services.

4. Tech Giants Enter Financial Services

- Companies such as Apple and Google integrate payment technologies like Apple Pay and Google Pay, capturing large market shares in proximity payments.

- Apple’s Apple Card offers cashback incentives, strengthening its financial ecosystem.

- Chinese tech firms Alibaba (Alipay) and Tencent (WeChat Pay) exemplify the blending of tech and banking at scale.

5. Enhanced Cybersecurity Measures Combat Financial Crime

Banks face significant cyber threats, with billions lost to attacks. AI-driven fraud prevention and employee cybersecurity training (e.g., CybeReady) improve resilience, reducing risk and financial losses substantially.

6. Digital Payments and Cashless Transactions Dominate

- Digital wallets now lead point-of-sale transactions, surpassing credit and debit cards.

- Cash usage continues to decline sharply, accelerating banks’ need to innovate in digital payment solutions.

- The digital payments market is expanding, offering new revenue opportunities despite increased competition from non-bank entities.

7. Fintech-Bank Collaborations Drive Growth and Innovation

Partnerships between banks and fintechs are increasingly common and mutually beneficial. These alliances help banks improve efficiency, expand customer bases, and reduce costs while providing fintechs with capital and regulatory expertise. Investment in fintech by major banks is rising, supporting a collaborative ecosystem that fosters financial innovation.

Conclusion

The banking sector is undergoing profound changes fueled by technology, shifting consumer preferences, and regulatory evolution. From AI and neobanks to open banking and tech giant involvement, the landscape is becoming more digital, customer-centric, and interconnected. Banks that embrace these trends and foster fintech partnerships will be positioned to thrive in the rapidly evolving financial ecosystem.