TL;DR Summary of The Rise of RedNote Amid TikTok’s US Ban Drama

Optimixed’s Overview: How RedNote is Shaping the Future of Social Media Post-TikTok Ban Threat

Background and TikTok Ban Developments

Early 2025 saw a surge in RedNote’s popularity as the US government announced plans to ban TikTok over national security concerns. TikTok, owned by ByteDance, faced a deadline to either sell its US operations or shut down. Despite multiple deadline extensions and legal battles, a deal was struck with Oracle and Silver Lake acquiring an 80.1% stake, allowing TikTok to continue operating, albeit under scrutiny.

RedNote’s Rapid Growth and User Demographics

- Users: Approximately 350 million monthly active users worldwide, with over 12.5% from the US.

- Engagement: US users spend on average 18 minutes and 39 seconds per visit, browsing 14.4 pages.

- Age Groups: 43.8% of users are aged 18-24, with millennials making up a significant portion as well.

- Gender Split: RedNote’s user base is predominantly female (72%), though US influx is balancing this ratio.

Platform Features and Social Commerce

Originally launched as a shopping guide, RedNote has evolved into a hybrid platform combining short-form videos, images, and text posts. It is heavily focused on beauty, fashion, and lifestyle content, with nearly 1 billion posts tagged under “makeup sharing.” Unlike TikTok, RedNote is a unified global platform without separate Chinese and international versions.

Social commerce is a major strength, with over 170,000 brands present and enterprise stores paying modest commissions. Users can open personal stores commission-free, driving significant in-app purchasing activity estimated to exceed $100 billion in gross merchandise value globally for 2025.

Competition and Market Position

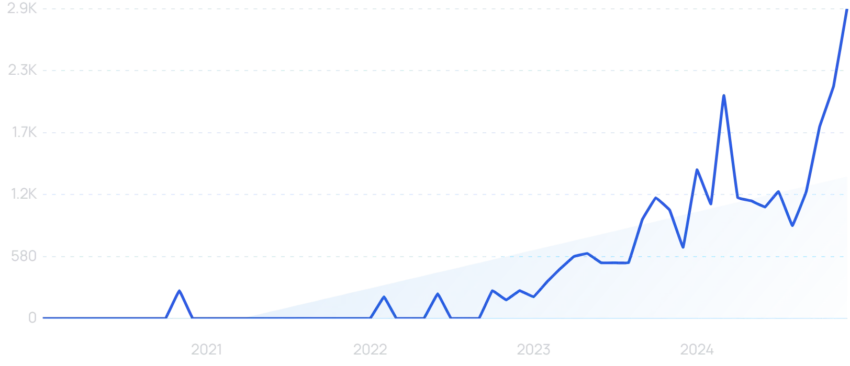

Despite the surge in RedNote’s US downloads—jumping from 508,000 in Q4 2024 to 3.7 million in Q1 2025—the app is not a direct TikTok clone. It blends elements of Instagram, Pinterest, and even Tripadvisor, offering a lifestyle-focused alternative rather than a pure short-video platform. Other competitors gaining traction include decentralized networks like Bluesky and Pixelfed, which appeal to users seeking alternatives to centralized platforms.

Outlook and Considerations

- RedNote’s Future: While currently tailored to a Chinese audience, RedNote must adapt to retain “TikTok refugees” and expand its US user base.

- Security Concerns: The US government’s scrutiny of Chinese apps continues, but RedNote has not faced similar bans or restrictions in the US so far.

- TikTok Stability: TikTok’s deal with Oracle has postponed the ban, but changes to its algorithm and ownership structure may shift user experience.

- Social Media Landscape: The TikTok ban saga has accelerated exploration of alternatives, making platforms like RedNote and Bluesky key players in evolving social media trends.

In summary, RedNote has capitalized on geopolitical tensions to grow its global presence and is poised to remain a significant social commerce and lifestyle platform. While it may not replace TikTok’s exact user experience, it offers a distinctive and rapidly expanding alternative worth monitoring.