TL;DR Summary of Snapchat Q4 2025 Performance Update: User Decline and Revenue Growth Amid New Challenges

Optimixed’s Overview: Snapchat’s Strategic Crossroads Amid User Declines and AR Ambitions

Snapchat’s User Base and Revenue Dynamics

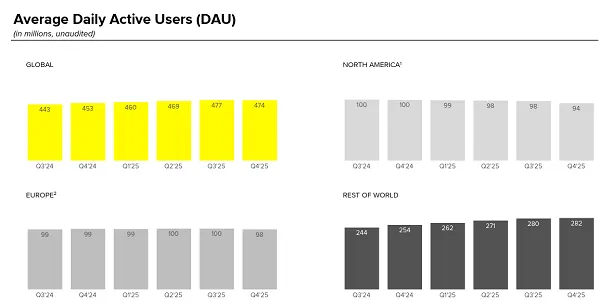

Snapchat’s latest update reveals a complex picture: while daily active users have dropped due to geopolitical restrictions and market saturation, the platform’s revenue continues to climb. The ban in Russia and Australia’s new under-16 social media rules collectively reduced potential users by around 8.5 million, yet the net DAU drop was only 3 million, indicating strong user retention elsewhere.

- Declining users in major markets: The U.S. and EU show continued user declines, signaling saturation and the need for new growth strategies.

- Revenue growth through ads and subscriptions: Q4 revenue reached $1.72 billion, a 10% increase year-over-year, with subscription services like Snapchat+ growing 71% to 24 million subscribers.

- Heavy reliance on U.S. market: Revenue per user outside the U.S. remains flat, highlighting opportunities for international growth.

Focus on Advertising Innovation and SMB Expansion

Snapchat is prioritizing three advertising initiatives aimed at sustainable, profitable growth:

- Brand-Snapchatter connections: Leveraging core product features to deepen direct engagement.

- AI-powered ad tools: Enhancing creative development, campaign setup, and performance optimization to improve advertiser success.

- Scaling SMB support: Expanding go-to-market operations to grow the small and medium-sized business advertiser base.

This strategic shift is designed to maximize monetization of the existing audience rather than rely solely on expanding the user base, a critical adaptation given stagnant or declining active user numbers.

AR Specs: Opportunity and Risk in Emerging Spatial Computing

Snapchat’s AR Specs represent a bold push into spatial computing, building on years of AR innovation and platform development. However, the device faces stiff competition from Meta’s forthcoming AR glasses, expected to surpass Snap’s offering in functionality and user experience.

- First-mover advantage: Snap’s long development timeline positions it ahead in market entry.

- Competitive challenges: Meta’s superior hardware and vast resources pose significant threats to Snap’s AR Specs success.

- Business unit separation: Snap has isolated the AR Specs division to protect its core business from potential losses.

Ultimately, Snapchat’s strength lies in its software ecosystem and AR platform, but its hardware ambitions will require careful management to avoid costly missteps as the AR glasses market evolves.

Conclusion: Navigating User Retention and Innovation for Future Growth

Snapchat faces a critical juncture where balancing user experience with revenue generation is paramount. While monthly active users continue growing, the decline in daily engagement and heavy ad reliance could risk alienating users. The success of subscription offerings and AR ventures will be vital to offset these challenges. As competition intensifies, particularly from Meta, Snap’s ability to innovate and optimize its platform and monetization strategies will determine its trajectory in the evolving social media and spatial computing landscapes.