TL;DR Summary of The AI-Driven Surge in Quant Fund Investing

Optimixed’s Overview: How AI Is Transforming Quantitative Investing and Market Strategies

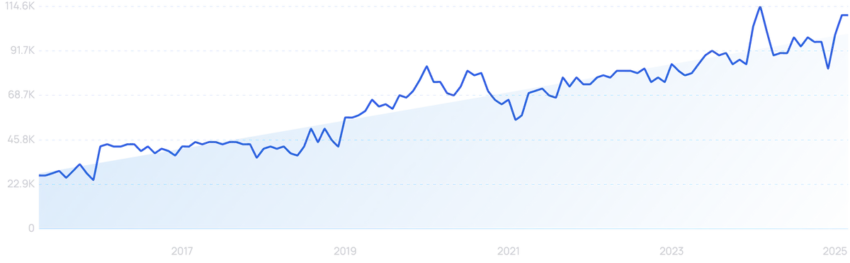

Rapid Growth and Mainstream Adoption of Quant Funds

Quantitative funds, which rely entirely on numerical data and mathematical models rather than human discretion, have seen a massive surge in popularity. Searches for “quant funds” have increased over 1100% in five years, coinciding with AI’s rise as a major force in investment technology. These funds now represent over 35% of the US stock market capitalization, managing assets worth close to $11 trillion.

AI’s Role in Enhancing Quantitative Strategies

- Advanced AI Models: Companies like High-Flyer’s DeepSeek and crowdsourced platforms such as Numerai use AI to optimize investment decisions across multi-billion dollar portfolios.

- Crowdsourced Innovation: Platforms reward data scientists for developing predictive models, accelerating continuous improvement in algorithmic trading.

- Automated Allocation: Quantiacs allocates real money to top-performing AI models, providing profit-sharing incentives and transparent performance metrics.

Democratization of Quant Investing Through AI Tools

AI technologies are lowering barriers for retail investors and fund managers. Tools like Capitalise.AI allow users to create automated trading rules via natural language, removing the need for coding expertise. This trend suggests a future where individual investors can compete more directly with traditional quant funds.

Current Performance and Challenges of AI Investing

- Performance Parity: Over a decade, AI-driven funds have delivered returns comparable to traditional hedge funds, indicating AI’s growing reliability.

- Limitations: AI predictions outperform analysts in many cases but can fall short where deep institutional knowledge is vital.

- Ongoing Risks: AI “hallucinations” (false outputs) and potential market volatility due to synchronized AI-driven trades create risks that investors must manage carefully.

Emerging AI Investing Tools and Market Trends

AI-powered robo-advisors like WarrenAI and portfolio assistants like Magnifi provide personalized investment guidance, while fully automated AI trading bots are on the horizon. Meanwhile, interest in investing directly in AI-related stocks and funds has surged, reflecting confidence in AI’s long-term growth potential.

Conclusion: Embracing AI in the Investment Landscape

The integration of AI into quantitative investing is reshaping financial markets, offering enhanced efficiency and new opportunities. While caution is warranted due to inherent risks, investors who adopt AI-driven tools and strategies are poised to gain a competitive edge in an increasingly data-centric market environment.