TL;DR Summary of 37 Must-Know Startup Statistics for 2025

Optimixed’s Overview: Key Insights into the 2025 Global Startup Ecosystem and Trends

Current Landscape and Unicorn Growth

As of 2025, the startup scene is flourishing globally, with more than 1,200 billion-dollar unicorns. These private companies, valued over $1 billion, collectively reach a market worth around $4 trillion. ByteDance, owner of TikTok, ranks as the world’s most valuable startup at approximately $225 billion. FinTech leads in unicorn numbers, representing over 200 companies worldwide, with payment technology as a major sub-sector.

Geographic and Industry Hotspots

- United States: Top country for startups, nearly 4x more startup-friendly than the UK, hosting over 700 unicorns and key hubs like San Francisco and New York City.

- San Francisco: World’s highest-ranked startup city, scoring 710.966 on StartupBlink’s ecosystem index.

- Emerging Markets: India and China follow with substantial unicorn counts, while Saudi Arabia remains a high-GDP nation yet to produce a unicorn.

- Industry leaders: FinTech, AI, and SaaS dominate funding and valuations, with AI startups attracting over $40 billion annually and SaaS making up 20% of U.S.-based unicorns.

Funding Trends and Startup Challenges

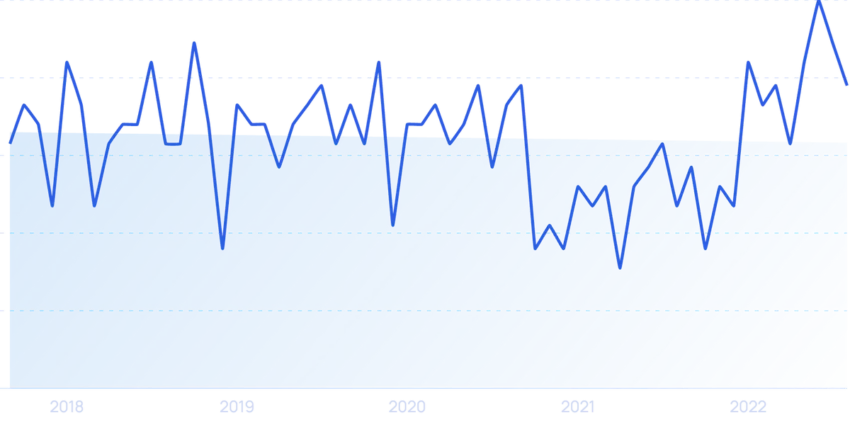

Startup funding remains volatile. Early-stage investments peaked at $229 billion in 2022 but fell to $103 billion in 2023. FinTech and food industries received the largest shares of capital, while AI funding surged 327% between 2016 and 2020. Despite this, three-quarters of VC-backed startups fail to return cash to investors, underscoring high risk.

Startup failure rates remain significant: 21% fail within the first year, 50% by year five, primarily due to running out of cash or lack of market need. Notable failures like Quibi highlight the challenges even well-funded startups face.

Founder Demographics and Performance

- Age: Average startup founder age is 42, debunking the myth of young college dropout founders; yet, teams with founders 25 or younger perform 30% better.

- Gender diversity: Female-founded startups outperform male-led ones by 63% in VC returns, though women face funding runway challenges.

- Ethnic diversity: Black founders represent a small but growing segment in accelerators like Y Combinator, with increasing valuations and funding.

- Educational backgrounds: Stanford leads U.S. universities in producing startup founders, followed by MIT, Harvard, and UC Berkeley.

Outlook

The global startup ecosystem continues to evolve, driven by technological innovation, geographic diversification, and increasing founder diversity. While failure remains prevalent, the potential rewards for successful startups are immense. The coming years will likely see more breakthroughs across industries such as healthcare, smart cities, and digital finance, with new unicorns emerging worldwide.