TL;DR Summary of Top Venture Capital Software Tools for Fund Management and Startup Discovery

Optimixed’s Overview: Essential Venture Capital Software Solutions to Optimize Fund Performance and Deal Sourcing

Comprehensive Startup Discovery and Market Trend Analysis

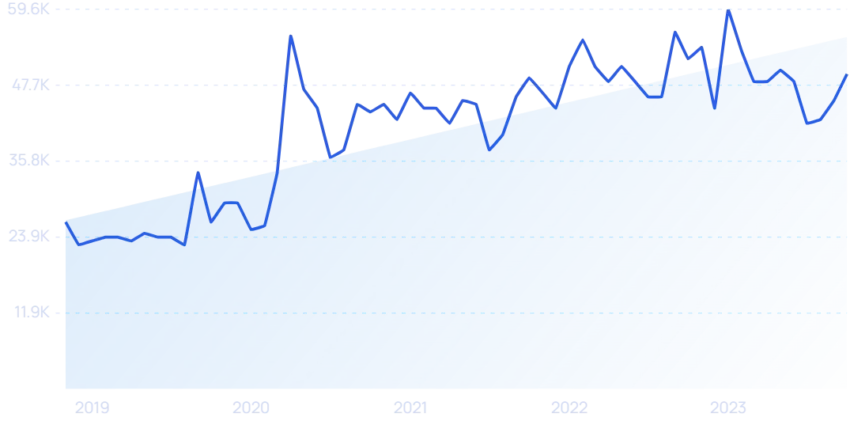

For early identification of high-potential startups and market trends, tools like Exploding Topics leverage AI combined with human expertise to analyze multiple online data channels, enabling VCs to spot emerging investment opportunities. Growjo complements this by providing a free, easy-to-use database featuring startup funding, employee counts, and revenue estimates.

In-Depth Financial Research and Pipeline Development

- PitchBook offers extensive financial data including valuations, funding sources, and advisory details, supporting comprehensive due diligence and investment benchmarking.

- Dealroom serves as a global database with over 2.5 million startups, empowering users to develop deal pipelines, monitor funding activities, and connect with founders and investors.

Efficient Deal Flow and Relationship Management

4Degrees specializes in deal flow and investor relationship management, helping VCs track interactions, maintain engagement reminders, and organize contacts by relevant criteria to optimize networking and deal progression.

AI-Powered Early-Stage Startup Sourcing

Harmonic.ai focuses on discovering stealth and pre-seed startups ahead of their fundraising rounds, offering customizable filters and enriched company profiles that integrate with existing CRM systems.

Advanced Portfolio Management and Fund Accounting

- Tactyc enables VCs to forecast fund performance, manage portfolios, and generate insightful reports, with pricing scaled by fund size.

- Carta streamlines back-office fund operations, providing automation, fund accounting, tax filing assistance, and audit-compliant valuations to maintain investor efficiency and regulatory compliance.

Choosing the Right VC Tech Stack

Successful venture capital management often requires a combination of these specialized tools. Early-stage discovery platforms, financial research databases, relationship management systems, and portfolio accounting solutions together create a robust infrastructure that supports informed investment decisions and efficient fund operations.