TL;DR Summary of Best CB Insights Alternatives for Trend Discovery and Market Intelligence

Optimixed’s Overview: Top Market Intelligence Platforms to Enhance Your Trend and Investment Insights

Exploring Comprehensive Alternatives to CB Insights for Business and Investment Research

CB Insights is a popular tool for corporate strategists, investors, and entrepreneurs primarily focusing on M&A and investments within six key industries. However, depending on your needs—such as broader industry coverage, pricing flexibility, or specific data features—several alternatives offer compelling advantages.

Key Alternatives and Their Strengths

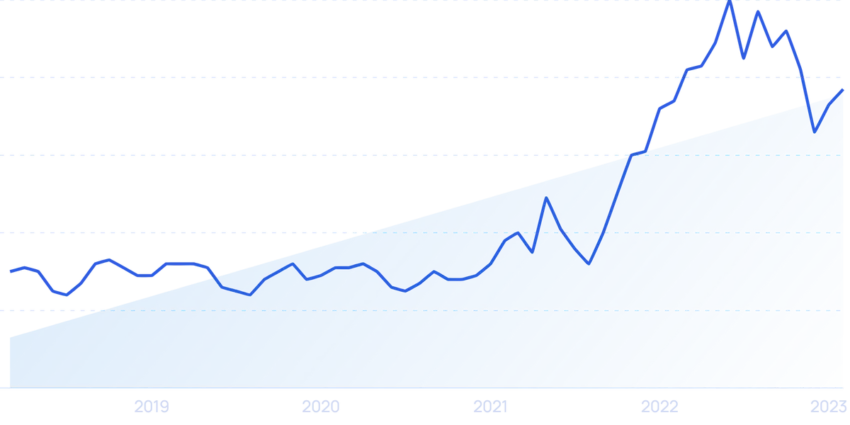

- Exploding Topics: Covers over 30 industries, including beauty, crypto, fashion, and tech, using 15 years of Google search data combined with AI to predict emerging trends. Offers a free tier and Pro plans starting at $39/month, making it accessible for marketers and product developers seeking early trend insights.

- Crunchbase: Provides rich company and investor data across 46 industries, suitable for sales, investment, and business development. It has a free basic plan, with paid tiers starting at $29/month, ideal for investors and sales teams looking to track decision makers and funding activity.

- S&P Global Market Intelligence: Focused on financial data and risk analysis for private equity, banking, and corporate sectors. Pricing is custom-quoted, targeting firms requiring deep investment and lending insights.

- Tracxn: Specialized in private company data and trending startup topics across 1800+ niches. Designed for teams with a minimum 3-seat subscription starting at $13,200/year, suitable for institutional investors and compliance organizations.

- Owler: Geared towards competitive intelligence with data on 15 million companies. Offers a free plan with limited tracking and a Pro plan at $39/month, fitting sales and market research professionals monitoring competitors.

- Harmonic: A startup discovery platform aggregating data on over 30 million companies and professional profiles. It focuses on real-time updates for VCs and investment teams, with custom pricing tailored to enterprise needs.

- PitchBook: Provides extensive private equity and venture capital market data, including deals and valuations. Pricing is enterprise-level (typically $20,000+ annually), catering to large financial organizations requiring detailed deal tracking and analysis.

Choosing the Right Platform

When selecting a market intelligence or trend discovery tool, consider these factors:

- Industry coverage: Broad vs. niche sectors depending on your target markets.

- Pricing structure: Free access, subscription tiers, or high-cost enterprise solutions.

- Data focus: Startup trends, financial transactions, competitive intelligence, or marketing insights.

- Team size and usage: Solo entrepreneurs vs. large corporate or investment teams.

For immediate access to emerging trends and a wide variety of industries without high costs, Exploding Topics is a strong starting point. Enterprise users focused on financial and investment research might prefer PitchBook or S&P Global Market Intelligence. Meanwhile, Crunchbase offers a balanced solution for both sales and investment professionals.