TL;DR Summary of 10 Best Crunchbase Alternatives for Startup Research and Investment

Optimixed’s Overview: Top Tools Empowering Startup Discovery, Investment, and Market Research Beyond Crunchbase

Exploring Versatile Platforms to Enhance Startup Intelligence and Deal-Making

Crunchbase has long been a go-to resource for investors, founders, and sales professionals seeking comprehensive company data including funding stages, investor details, and technology stacks. However, depending on your specific objectives—whether sourcing early-stage startups, conducting M&A due diligence, or building investor pipelines—several alternative platforms offer unique strengths and pricing models suited to diverse needs.

Key Alternatives and Their Strengths

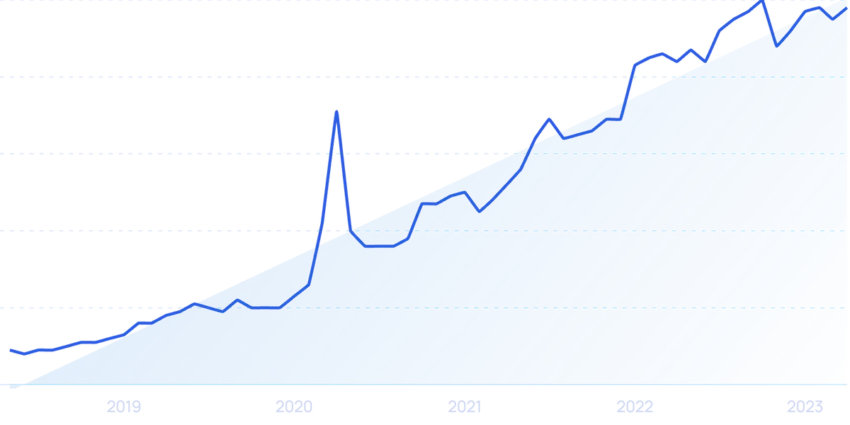

- Exploding Topics: Uses AI and expert analysis to spotlight under-the-radar, fast-growing startups and industry trends, ideal for early-stage discovery.

- Dealroom: Extensive startup and investor database with government-verified data and bespoke research assistance, great for founders seeking investors and institutional users.

- PitchBook: Comprehensive market intelligence with multi-platform access tailored for M&A teams and deep deal analysis.

- Mattermark: Focuses on data-driven venture capital portfolio building with detailed funding history and location insights.

- Owler: Community-powered startup news and updates, excellent for tracking competitor activity and receiving daily personalized alerts.

- Harmonic AI: Early-stage VC discovery platform featuring AI-powered search and founder/team-level insights.

- Acquire: Specialized marketplace for startup acquisitions, supporting both independent and guided deals with valuation tools.

- Affinity: CRM designed for dealmakers to organize contacts and manage pipelines seamlessly integrated with email and calendar data.

- Growjo: Free resource providing quick access to startup headcount growth, revenue, and funding metrics for high-level research.

- Unicorn Nest: VC database combined with assisted fundraising solutions, valuation comparisons, and investor pipeline management for founders.

Choosing the Right Tool for Your Startup Journey

Beginners or those exploring their market landscape may benefit from free or low-cost options like Growjo and Unicorn Nest. Investors and founders ready to advance dealmaking efforts can leverage premium services such as PitchBook, Dealroom, or Exploding Topics to gain deeper insights and data accuracy. Tools like Affinity and Harmonic AI add value by enabling relationship management and granular startup discovery respectively.

Ultimately, integrating multiple platforms tailored to your specific use case can optimize startup research, investment sourcing, and competitive intelligence—empowering smarter decisions and faster growth.