TL;DR Summary of How to Find Promising Startups to Invest In

Optimixed’s Overview: Strategic Approaches to Discover and Invest in High-Growth Startups

Leveraging Data-Driven Tools to Identify Startups

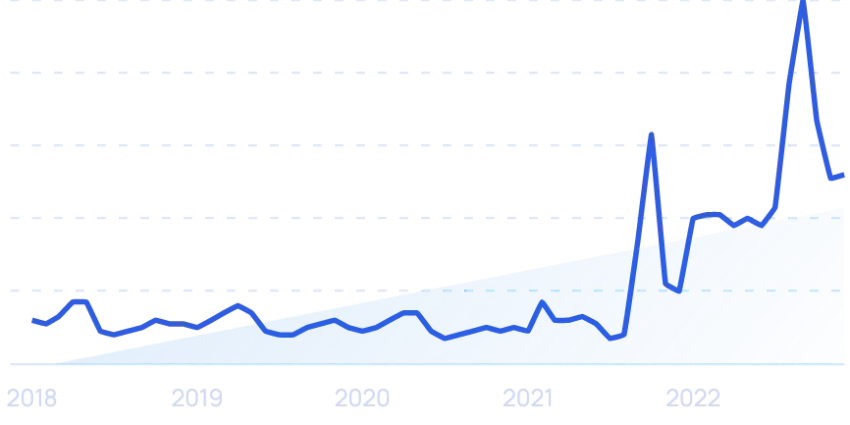

Traditional startup directories often overwhelm investors with numerous options but lack precision in highlighting truly promising ventures. Instead, utilizing tools that track brand search volume trends offers a powerful metric to assess consumer interest and potential growth trajectory. Features like filtering by funding rounds, employee count, and location help investors narrow down their targets efficiently. Additionally, exploring meta trends enables investors to spot startups within rapidly expanding niches, while tracking product popularity on social media channels provides further validation.

Building Relationships and Engaging Offline

- Networking with Top Investors: Cultivating meaningful connections with experienced investors can generate passive deal flow and introduce exclusive opportunities.

- Attending Startup Events: Participation in hackathons, accelerator demo days, and industry conferences facilitates direct interaction with founders, fostering trust and insight into their ventures.

- Offering Mentorship: Providing guidance to early-stage founders not only supports startup growth but also grants early access to promising investment opportunities.

Utilizing Investment Platforms and Communities

For investors seeking streamlined exposure, platforms such as AngelList allow co-investing alongside top venture capital firms or individual VCs via rolling funds, mitigating risks through diversification and expertise. Crowdfunding sites offer similar opportunities for non-accredited investors. Joining online and offline communities or masterminds builds long-term relationships with founders and investors, enhancing deal sourcing and due diligence capabilities.

Practical Tips for Investors

- Track products and services you personally use to identify startups with genuine product-market fit.

- Host or participate actively in events to increase your visibility and appeal among startup founders.

- Use data-backed platforms to monitor trending startups and validate their momentum before investing.

By combining data insights with authentic network-building and leveraging specialized platforms, investors can efficiently discover and capitalize on high-potential startup opportunities, maximizing their chances for successful investments.