TL;DR Summary of 2025 SaaS Benchmarks: Growth, AI Impact, and Monetization Insights

Optimixed’s Overview: Key Trends and Strategic Insights from the Latest SaaS Industry Data

Stability Amid Change: Growth and Profitability Trends

The 2025 SaaS Benchmarks report, based on survey data from over 800 B2B SaaS companies, demonstrates a continued theme of market stabilization with most key metrics holding steady from previous years. However, notable shifts include:

- Early-stage startups (<$1M ARR) are growing faster again, reaching 300% year-over-year growth.

- Gross margins have declined nearly 10 percentage points for early-stage firms, largely due to increased AI-related costs.

- Later-stage companies are achieving profitability with fewer employees, significantly increasing ARR per full-time employee (FTE) by 42-50% for companies above $20M ARR.

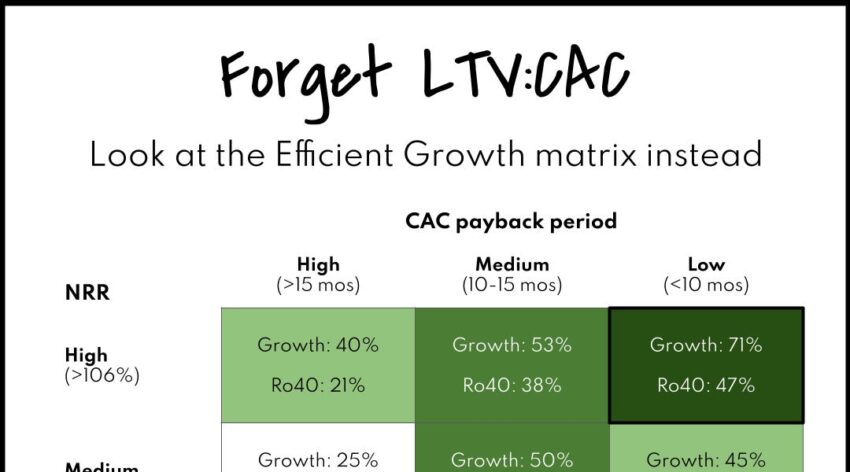

Efficient Growth: The Critical Role of NRR and CAC Payback Period

Long-term, profitable SaaS growth correlates strongly with two metrics:

- Net Revenue Retention (NRR) – reflecting customer loyalty and expansion.

- Customer Acquisition Cost (CAC) Payback Period – the time to recover the cost of acquiring a customer.

The Efficient Growth matrix categorizes companies by these metrics, identifying a “cash cow zone” with high growth and rule of 40 scores for companies with high NRR and low CAC payback.

The AI Effect: Growth Acceleration and Workforce Changes

- Approximately 70% of companies have launched AI features; 36% consider AI core to their product.

- AI-native startups founded since 2022 grow three times faster than traditional SaaS peers but have slightly lower gross margins.

- Public and private companies report increased ARR per employee due to AI-driven productivity gains; Shopify’s ARR per employee tripled recently.

- AI is reshaping workforce needs, with engineering, customer success, and marketing roles most impacted by headcount reductions.

- Demand for AI fluency in hiring has surged, with a 14-fold increase in GTM jobs requiring AI skills over two years.

Optimal Customer Segments: Deal Size and Growth Implications

Data analysis suggests targeting specific average contract values (ACV) yields better growth and retention:

- $10k–$25k deals combine effective inbound GTM strategies with strong growth (39%) and net revenue retention (106%).

- $50k–$100k deals favor account-based strategies, leveraging intent-based outbound and events to drive growth with less negotiation friction.

- Smaller deals (<$10k) face challenges with churn and sales efficiency, while mid-range deals ($25k–$50k) sit in a difficult position between inbound and account-based approaches.

Choosing the right deal size can significantly influence growth trajectory and customer longevity.