TL;DR Summary of State of Digital Agencies Survey 2025: Client Services and Operations Insights

Optimixed’s Overview: Key Trends and Operational Strategies Shaping Digital Agencies in 2025

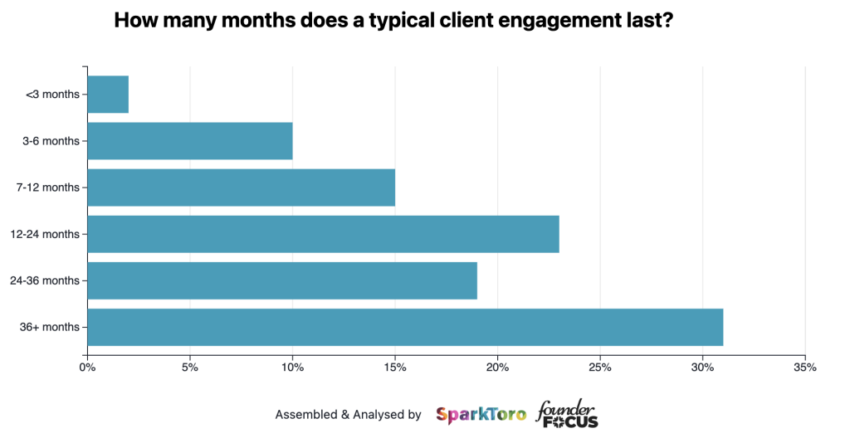

Extended Client Engagement and Staffing Trends

According to the latest survey, client retention has improved, with 31% of agencies reporting client relationships lasting over three years, signaling strengthened partnerships. Agency headcount shows modest growth, with 26% expanding teams and 40% planning to hire further within the next year, reflecting an optimistic hiring climate. Conversely, only a small fraction anticipate reductions in staffing, indicating relative stability in agency operations.

Account Management and Time Tracking Practices

- Account Managers: Larger agencies (50+ employees) predominantly employ dedicated account managers to coordinate multi-service delivery, whereas smaller agencies are split on this practice.

- Time Tracking: A slight majority (57%) utilize timesheets, with usage increasing alongside agency size. Among those tracking time, 65% set utilization targets, commonly ranging between 70-89% for mid-level staff.

Client Billing Models and Retainer Insights

The survey highlights a strong preference for retainer agreements, with 85% of agencies favoring this model to secure consistent revenue streams—an increase from 81% in 2024. Monthly retainers typically fall below $10,000, with nearly half between $1,000 and $5,000. Larger retainers exceeding $25,000 are mostly reported by agencies based in North America and Europe, while smaller retainers are more common in Africa, Asia, and Central/South America.

Freelancer Collaboration and Remote Client Interaction

- Nearly one-third of agencies reported increased collaboration with freelancers, suggesting a strategic move to mitigate operational risks.

- Remote client meetings via video calls are now standard practice for 80% of agencies, emphasizing the normalization of virtual engagement in client servicing.

Survey Demographics and Market Representation

The respondents represent a diverse cross-section of the digital agency landscape, predominantly small to medium-sized firms (1-50 employees) based in North America and Europe. The majority operate within $100K-$5M revenue brackets and specialize in SEO, SEM, content marketing, and analytics, providing a comprehensive snapshot of current industry practices and challenges.